The Mathematics of M-PESA 101

Welcome and in this blog we take look at M-PESA commission

tables and try and see what they tell us about the M-PESA service.

The analysis is based on 2012 Mpesa transaction Fees – the insights were very telling then and inform the design of mobile money economics today.

For my foreign readers, and they are the most, am sorry the

figures in the following tables are in Kenya Shillings, you are welcome to

convert them (using 1USD = 85KES), although not necessary in understanding and

following the discussion.

What is M-PESA

M-PESA is electronic mobile money issued by Kenyan MNO,

Safaricom Limited. The “M” = Mobile, and the PESA = Money is Swahili language.

M-PESA users buy the e-value by exchanging cash for e-value

at agents (merchants) outlets, this transaction called a deposit is offered

free of charge to M-PESA users at agents outlets.

Hence M-PESA users load e-value called Mpesa into their

phones, the Mpesa is the money offered by the M-PESA service.

SMS notifications act as alerts for confirmation of user’s

actions;

- · Withdrawals, exchanging Mpesa for cash.

- · Transfers, of Mpesa to other registered users and nonregistered users

- · Deposits, putting Mpesa into a mobile phone wallet.

- · Purchases, C2B transfers for payments of services.

M-PESA Customer Charges.

|

Customer Charges

|

|||||||||

|

Transaction Range (KShs)

|

Transaction Type and Customer

Charge (KShs)

|

Percentage of Customer Transaction Paid as Commissions

|

|||||||

|

Transaction Band

|

Min

|

Max

|

Transfer to other

|

Transfer to

Unregistered Users

|

Withdrawal from

|

Analysis

|

|||

|

M-PESA Users

|

M-PESA Agent

|

Mean of Transaction

Range

|

Send To M-PESA Users

|

Send To Unregistered

Users

|

Withdrawal From M-PESA

Agents

|

||||

|

1

|

10

|

49

|

3

|

N/A

|

N/A

|

29.5

|

10.17%

|

N/A

|

N/A

|

|

2

|

50

|

100

|

5

|

N/A

|

10

|

75

|

6.67%

|

N/A

|

13.33%

|

|

3

|

101

|

500

|

25

|

60

|

25

|

300.5

|

8.32%

|

19.97%

|

8.32%

|

|

4

|

501

|

1,000

|

30

|

60

|

25

|

750.5

|

4.00%

|

7.99%

|

3.33%

|

|

5

|

1,001

|

1,500

|

30

|

60

|

25

|

1250.5

|

2.40%

|

4.80%

|

2.00%

|

|

6

|

1,501

|

2,500

|

30

|

60

|

25

|

2000.5

|

1.50%

|

3.00%

|

1.25%

|

|

7

|

2,501

|

3,500

|

30

|

80

|

45

|

3000.5

|

1.00%

|

2.67%

|

1.50%

|

|

8

|

3,501

|

5,000

|

30

|

95

|

60

|

4250.5

|

0.71%

|

2.24%

|

1.41%

|

|

9

|

5,001

|

7,500

|

50

|

130

|

75

|

6250.5

|

0.80%

|

2.08%

|

1.20%

|

|

10

|

7,501

|

10,000

|

50

|

155

|

100

|

8750.5

|

0.57%

|

1.77%

|

1.14%

|

|

11

|

10,001

|

15,000

|

50

|

200

|

145

|

12500.5

|

0.40%

|

1.60%

|

1.16%

|

|

12

|

15,001

|

20,000

|

50

|

215

|

160

|

17500.5

|

0.29%

|

1.23%

|

0.91%

|

|

13

|

20,001

|

25,000

|

75

|

250

|

170

|

22500.5

|

0.33%

|

1.11%

|

0.76%

|

|

14

|

25,001

|

30,000

|

75

|

250

|

170

|

27500.5

|

0.27%

|

0.91%

|

0.62%

|

|

15

|

30,001

|

35,000

|

75

|

250

|

170

|

32500.5

|

0.23%

|

0.77%

|

0.52%

|

|

16

|

35,001

|

40,000

|

75

|

N/A

|

250

|

37500.5

|

0.20%

|

N/A

|

0.67%

|

|

17

|

40,001

|

45,000

|

75

|

N/A

|

250

|

42500.5

|

0.18%

|

N/A

|

0.59%

|

|

18

|

45,001

|

50,000

|

100

|

N/A

|

250

|

47500.5

|

0.21%

|

N/A

|

0.53%

|

|

19

|

50,001

|

70,000

|

100

|

N/A

|

300

|

60000.5

|

0.17%

|

N/A

|

0.50%

|

Table 1: Mpesa

End User Charges

Observations and Comments

The Transaction Bands

Current M-PESA (June 2012) has 12 charge bands corresponding

to different amounts that an M-PESA user can transact, ranging from KES 10.00

to KES 70,000.00

Transaction bands 1 could as well start at minimum value KES

1.00 and end at maximum value KES 50.00, then band 2 at KES 51.00 and end at

100.00, that way uniformity down the bands could have been maintained. These

two bands are the latest addition to Mpesa transaction bands.

The Spacing of the bands is very instructive in getting an

indicator where the most transactions are prevalent; between KES 10 and KES

10,000 there are ten transaction bands, while between KES 10,000 to KES 70,000

nine bands. Ordinary M-PESA users transact over 95% of their transactions below

KES 5,000.

What Can You Do With M-PESA

Once an M-PESA user has Mpesa (e-float acquired via a

deposit operations) in their phones they can do the following;

- · Transfer e-float (Mpesa) to other M-PESA users.

- · Transfer e-float to other non-registered users.

- · Withdraw e-float; convert to cash

Other uses of M-PESA not covered in table 1 above are:

- · ATM withdrawals, the withdrawals in table 1 are at an agent’s outlet.

- · Pay bill transactions, this are C2B transfers, and are commonly used for utility payments, subscription services, school fees.

- · Buy Goods transactions; also a C2B transfer at payment counters in restaurants, bars, supermarkets.

- · Buy Airtime, for your phone or somebody’s else phone

Analysis of Customer Charges

To simplify the analysis, the mean of the transaction band

is used, (min+max)/2.

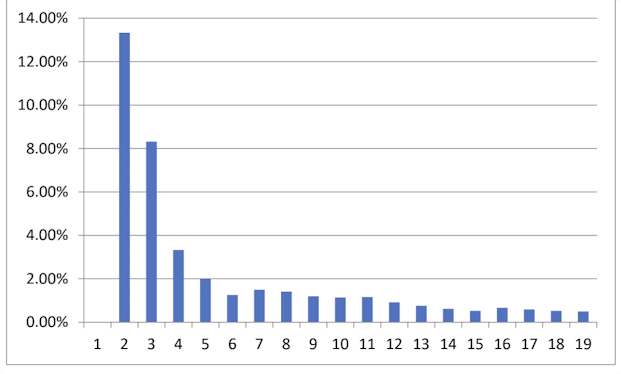

Based on this the following three graphs derived to depict

what an M-PESA user is charged as a percentage of the value of the transaction.

Graph 1: Mpesa Transfers to Other M-PESA Users

The first three bars are packed with information and

interpretations.

Band 1, the first bar, KES 10-49, first this value cannot be

withdrawn at an M-PESA agent, secondly if I were sending it to you to buy

airtime top up, we are both better off if I just bought for you through my

phone.

Hence the only situation I would be sending you that value

(between 10-49) must be in a situation where you needed a top up of your

e-float so as to enable you to carry out another M-PESA transaction like a

withdrawal, and so in a monetary emergency.

Safaricom could also be envisaging a situation where small

merchants, who cannot register to get M-PESA business accounts could be

receiving Mpesa transfers from M-PESA users as payment for services, actually

very feasible taking cognizant of the many, varied and unintended (by design)

uses Mpesa is used for.

M-PESA transfer volumes are highest between transfer band 3

and 7 (KES 101 - KES3, 000).

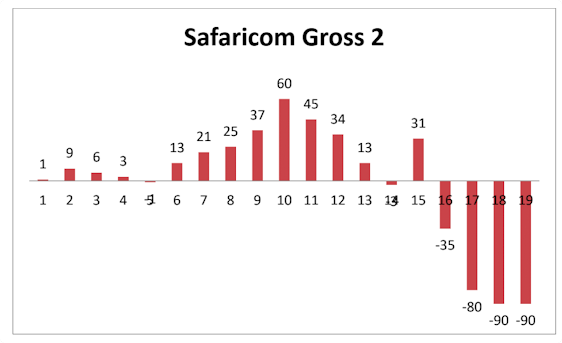

Graph 2: Mpesa Transfers to Non-registered M-PESA Users

Note that transfers between KES 10 and KES 100, band 1 and

2, and those above KES 35,000, band 16, 17, 18 and 19, are not allowed.

The whole structure of the commissions is to deter sending

money to nonregistered users.

This in effect turns the registered M-PESA users into product

champions, extolling the benefits of registering on M-PESA to their relatives

and friends that they send money too.

Graph 3: Withdrawal From M-PESA Agents

The bars in this particular graph show a beautiful motion

dumping curve and further dove tails in an earlier observation (20,000

beautiful ones) that Tier-3 M-PESA agents are always ready to transact higher

withdrawal services than deposit service.

But that is not even the beauty of it, this curve is

business analytics and strategy applied to the max.

One, withdraws of KES 10 to KES 49, band 1 are not allowed.

Two, withdraws of 50 to 100, band 2 are punished, hence if

it is airtime, better buy it from the M-PESA menu, thereby driving, encouraging

and showing it is safe to carry out mobile commerce.

Three, the highest volumes of withdrawals occur in band 3,

KES 101 to KES 500 and this is the same for the other two types of transactions

above; transfers to registered and nonregistered users.

M-PESA agents’ commissions tariff structure next.

M-PESA Agents Commissions.

|

Agent Commissions for Withdrawal

Transactions

|

Percentage

of Transaction Value Received As Commission

|

|||||||

|

Transaction Bands (KShs)

|

(Registered Customers)

|

(Unregistered Customers)

|

Deposit Registered

Users Only

|

Mean of Transaction

Range

|

Withdrawal

Users

|

Withdrawal

None Users

|

Deposit

Users Only

|

|

|

10

|

49

|

N/A

|

N/A

|

N/A

|

29.5

|

N/A

|

N/A

|

N/A

|

|

50

|

100

|

5

|

N/A

|

4

|

75

|

6.67%

|

N/A

|

5.33%

|

|

101

|

500

|

8

|

8

|

8

|

300.5

|

2.66%

|

2.66%

|

2.66%

|

|

501

|

1,000

|

10

|

10

|

9

|

750.5

|

1.33%

|

1.33%

|

1.20%

|

|

1,001

|

1,500

|

12

|

12

|

10

|

1250.5

|

0.96%

|

0.96%

|

0.80%

|

|

1,501

|

2,500

|

15

|

15

|

11

|

2000.5

|

0.75%

|

0.75%

|

0.55%

|

|

2,501

|

3,500

|

20

|

20

|

12

|

3000.5

|

0.67%

|

0.67%

|

0.40%

|

|

3,501

|

5,000

|

25

|

25

|

14

|

4250.5

|

0.59%

|

0.59%

|

0.33%

|

|

5,001

|

7,500

|

30

|

30

|

20

|

6250.5

|

0.48%

|

0.48%

|

0.32%

|

|

7,501

|

10,000

|

35

|

35

|

28

|

8750.5

|

0.40%

|

0.40%

|

0.32%

|

|

10,001

|

15,000

|

45

|

45

|

40

|

12500.5

|

0.36%

|

0.36%

|

0.32%

|

|

15,001

|

20,000

|

60

|

60

|

55

|

17500.5

|

0.34%

|

0.34%

|

0.31%

|

|

20,001

|

25,000

|

65

|

65

|

71

|

22500.5

|

0.29%

|

0.29%

|

0.32%

|

|

25,001

|

30,000

|

70

|

70

|

87

|

27500.5

|

0.25%

|

0.25%

|

0.32%

|

|

30,001

|

35,000

|

70

|

70

|

103

|

32500.5

|

0.22%

|

0.22%

|

0.32%

|

|

35,001

|

40,000

|

100

|

N/A

|

119

|

37500.5

|

0.27%

|

N/A

|

0.32%

|

|

40,001

|

45,000

|

150

|

N/A

|

135

|

42500.5

|

0.35%

|

N/A

|

0.32%

|

|

45,001

|

50,000

|

180

|

N/A

|

150

|

47500.5

|

0.38%

|

N/A

|

0.32%

|

|

50,001

|

70,000

|

200

|

N/A

|

190

|

60000.5

|

0.33%

|

N/A

|

0.32%

|

Table 2: Mpesa Agents

Commissions

Observations and Comments

The Transaction Bands

The agents’ commission table has nineteen transaction bands,

same as the customers.

Mpesa customers cannot deposit or withdraw values below 49

KES at an agent’s outlet, but can transfer that amount to other users.

Withdraw Commissions

This is a cash out operations, with customers giving the

agent Mpesa and receiving cash money in exchange.

Two graphs below show agents’ commissions against what the

customer pays Safaricom for this service and the second one agents’ commissions

against the money they pay out.

Graph 4: Percentage of Agents Commissions Against Customer Fees

Graph 5: Percentage of Agents Commissions against Cash Paid Out

Please note that withdraw commissions for non-Mpesa registered users are the

same as for registered Users.

Deposit Commissions

Customers don’t pay for depositing Mpesa into their

e-wallets, but the Agent carrying out that service is paid a commission by

Safaricom.

Graph 6: Agents Commission For Deposits

Safaricom Commissions

Safaricom Limited is both the platform owner and also the

access network provider for M-PESA.

Through the M-PESA platform Safaricom enables electronic mobile

money service that provides Mpesa money.

Agent buy Mpesa from Safaricom through commercial Banks,

they then sale exchange it for cash to customers.

M-PESA customers get equivalent Mpesa money at M-PESA agents’

outlet equivalent to the cash they hand in, for this service called a deposit

from the perspective of the customer no commission fee is paid, although the

agent gets a commission for that deposit transactions.

With the Mpesa money in their mobile wallets, customers can

transfer to other registered or non-registered users (C2C or P2P) at a commission

fee, withdraw (change to cash) at an agents outlet at fee, transfer to

corporate bodies (C2B) at a fee or buy Safaricom top up airtime at no fee.

So starting when a customer deposits and moving to a

withdraw and then a transfer, the following is noted;

On deposit Safaricom pays out a commission to the agent

carrying out the transaction, Safaricom is hence on a negative position, since

it has paid out and as long as the customer keeps that mobile money (Mpesa) in

their mobile e-wallet and don’t transact on it Safaricom has no other means to

earn of the equivalent cash it is holding, unless the holding banks give it an

interest.

Hence Safaricom is always on the lookout for ways and means

that can compel the customer to spend the Mpesa in their mobile wallets.

The initial push for Mpesa usage was C2C transfers enabling transfer

between individuals.

The current push for Safaricom is to make the customers

comfortable buying digital goods (airtime etc) and paying for services using

mobile wallets.

Now back to our analysis.

So, Safaricom pays a commission to agents on customer

deposits, then when the customer does a withdrawal it charges the customer for

this service and also pays the agent a commission for facilitating the

withdrawal.

Looking at this two operations, deposit and withdrawal,

where agents get a commission, Safaricom position is depicted on the next two graphs

below.

On withdrawal, we get the graph Safaricom Gross 1: what Safaricom keeps (KES) on a withdrawal after

paying the agent.

Graph 7: Safaricom Gross 1

On a deposit operation, the customer does not pay but the

agent gets a commission, Safaricom Gross

2 below depicts this situation.

Graph 8: Safaricom Gross 2

The above graph tells the story of M-PESA, why and how it

is designed:

This is supposed to be a transaction engine, profits can only be

made when transactions happen; transfers between customer to customer, customer

to business, business to customer and business to business.

Next with the M-PESA platform doing only customer to

customer transfers, the picture changes and now it becomes a worthwhile

business.

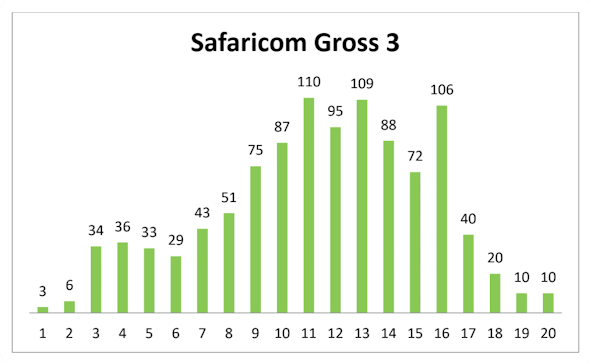

Safaricom Gross 3

graph below shows the gross effect of withdrawal, deposit, and transfer between

customers, that is we add the transfer commission gotten from customers doing a

registered to a registered customer transfer to the graph above.

Graph 9: Safaricom Gross 3

And here you can see the KES 3 shillings fee for customer to

customer transfer appearing for band 1 gross income in the above graph.

Well that brings us to the close of this session; hope you

got an insight or two in the design and operations of a mobile money offering.

Comments as usual are welcome.

Thank You.

Last update April 25 2022 23.37Hrs

Comments

Post a Comment